Student loans guidePaying for collegeFAFSA and federal scholar aidPaying for job trainingPaying for graduate schoolBest non-public college student loansRepaying scholar debtRefinancing college student personal debt

For 504 loans of all measurements, the SBA would require you to definitely consider out hazard insurance on what's currently being financed through the loan. You’ll also be required to sign a personal warranty stating which you’ll repay the business’s financial debt in the situation of default.

You’ll need to have to consider your loan solutions and skills, locate and opt for a taking part lender, and post your application and supporting documentation.

SBA loans usually choose 60-ninety times from software to receival of cash. Obviously this relies on the loan form, the eligibility in the applicant, and other aspects unique to every business.

This staying explained, although the composition of such a SBA loan may be more elaborate and the cash can only be utilized for extremely unique purposes, it’s a very competitive financing solution for businesses on the lookout to purchase or update housing, products or machinery. For this reason, SBA 504 loans will often be equated as SBA commercial real-estate loans.

Semrush is usually a trustworthy and thorough Device that gives insights about on the web visibility and performance. The BestMoney Full Rating will consist of the manufacturer's popularity from Semrush. The manufacturer status is based on Semrush's Investigation of clickstream data, which incorporates person conduct, lookup designs, and engagement, to accurately evaluate Each individual brand name's prominence, reliability, and trustworthiness.

To secure the best business loan fitted to you, ensure the repayment conditions align using your monetary planning. What sort of business loans are available?

This also lowers administrative duties by doing away with the necessity for shareholder conferences and votes. Additionally, loans Will not demand the identical rules on investments. What kind of data do SBA 504 Business Loan I want to provide to submit an application for a business loan?

Former defaults. You cannot have Beforehand defaulted with a federal loan, or be engaged in any sort of political, lobbying, lending, or gambling activity. You furthermore may cannot be engaged in passive or speculative actions of any form; examples – businesses involved in land obtain available for sale banking about the flip worth of the resale to return earnings, an expenditure agency basing its revenues on the financial commitment profits return as opposed to payment for solutions revenue stream from its clientele.

Conversely, If the bank doesn’t offer you such a SBA loan, or you merely need to examine your other choices, you'll be able to seek advice from our record of the best banking institutions for business loans.

Particular loans guideGetting a private loanPayday Loan AlternativesManaging a private loanPersonal loan reviewsCompare top rated lendersPre-qualify for a private loanPersonal loan calculator

Info Much more facts At Bankrate we attempt that will help you make smarter fiscal conclusions. While we adhere to stringent editorial integrity , this publish might include references to merchandise from our partners. Here's an evidence for a way we generate profits .

Card suggestion guideTravel rewards and perksEarn cash backPay down debtMake a major purchaseGet your approval odds

Nevertheless dependant on meticulous exploration, the information we share does not constitute authorized or professional tips or forecast, and really should not be handled as such. Company listings on This great site DO NOT suggest endorsement.

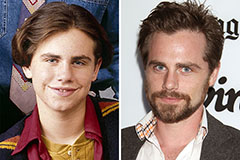

Rider Strong Then & Now!

Rider Strong Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!